This product offering is currently unavailable. We will be back soon. Till then please explore our other products.

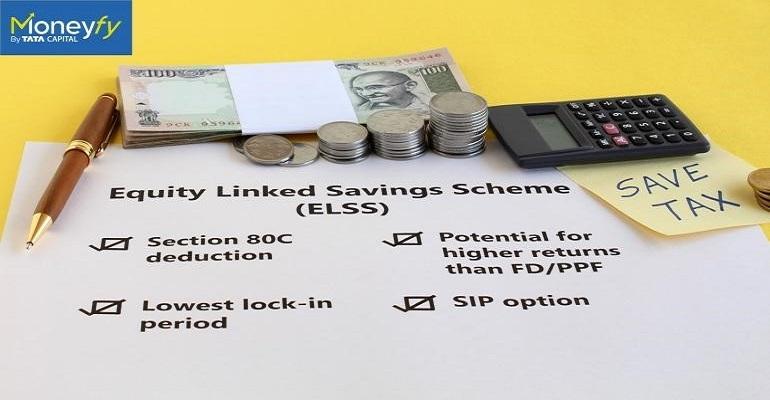

It is very crucial that you choose an investment product that suits your requirements and is right for you. Under the 1961's Section 80C of Indian Income Tax Act, there are certain investments that are eligible to have tax benefits of about Rs 1.5 Lacs. One such option of investment that is promising is Equity Linked Savings Schemes or ELSS. It is the type of investment that renders not only tax benefits but as well as wealth creation.

ELSS falls under one of the investment options in mutual funds. Within this category of mutual funds:

This is why, not only are you able to avail the tax benefits for about Rs 1.5 Lacs under this scheme by being eligible, but you are also able to opt for the higher amounts of investments available in ELSS. This ensures that you are on track towards fulfilling your financial goals and wealth creation.

Additional Read: 5 Ways to Minimize your Taxes and Maximize Investments

As an investor in ELSS, you can enjoy the following benefits:

With only three years as its lock-in period starting from the date you had invested on, this period of lock-in is the least amidst every other investment option that is eligible for tax-saving. Even with the given period of three years as a period of lock-in, as an investor you can choose to either continue to stay invested after the lock-in period expires and accumulate wealth or end your investment.

ELSS or Equity Linked Savings Schemes are a kind of investment option in mutual funds that are oriented towards equity. Investing in equity can aid in compounding your wealth for the longer run as equity is an asset class and possesses the potential in delivering returns that are inflation-indexed for the long period of time. With an investment option that aims for a longer horizon, possibilities in earning better and higher returns increase.

Many of the options for investments that are eligible for the tax benefits offer a return that is fixed. However, Equity Linked Savings Schemes provides returns that are variable which is linked with the investment portfolios and its performance. As a long-term investment equity market generates better returns and with ELSS, one can invest 65% of their portfolio in instruments related to equities, thus, by investing for tax saving in ELSS holds the potential for higher and better returns. These returns are additionally boosted by the savings that are generated via tax benefits. With Tata Capital's Moneyfy app, you can now calculate how much to invest in your portfolio. With its features like Mutual Fund Scanner, you can conveniently screen several mutual funds yourself to invest in.

As the funds have been locked-in for at least three years in ELSS, all the returns that are generated via investments in ELSS are classified as capital gains for long-term out of equity schemes. Which is why, the taxation of the returns are especially calculated at a rate of 10% in comparison to 30%, which is the maximum marginal rate. Additionally, there is a chance of availing zero tax for you as under the laws of income tax there is an exemption on capital gains that are long-term of Rs. 1 lac every year from mutual funds that are oriented to equities.

If you are looking for an investment that is going to help you in accomplishing your financial requirements along with aiding in accumulating wealth and you are prepared to invest for a long period of time then ELSS as an investment instrument is your go-to choice. Equities are very volatile and provide market-linked returns for short-term investments. This is why ELSS investments are always better if you are in it for the longer haul.

Additional Read: Is ELSS a Wealth Creation & Tax-Saving Tool?

Investing in mutual funds can be tricky as they offer high returns against investing in the risky and volatile market. This is why you must know all the ins and outs before deciding to invest in anything. However, once you know your way around investing in schemes like ELSS, you can gain high rewards and attain all your goals for the long-term.

If you want to invest yet are unsure of your options, then you can check out Tata Capital Moneyfy, which is a platform that can enable and aid you in investing. With the help of the Tata Capital Moneyfy app, you can invest in numerous fund houses. The platform helps in comparing investment options, setting your goals, selecting insurance, calculating returns and risks among many other features. The facilities offered are simple, fast and hassle-free via which you can now invest in mutual funds.